Credit score lowered for NEIU

Courtesy of Sarahy Lopez and Pikto Chart

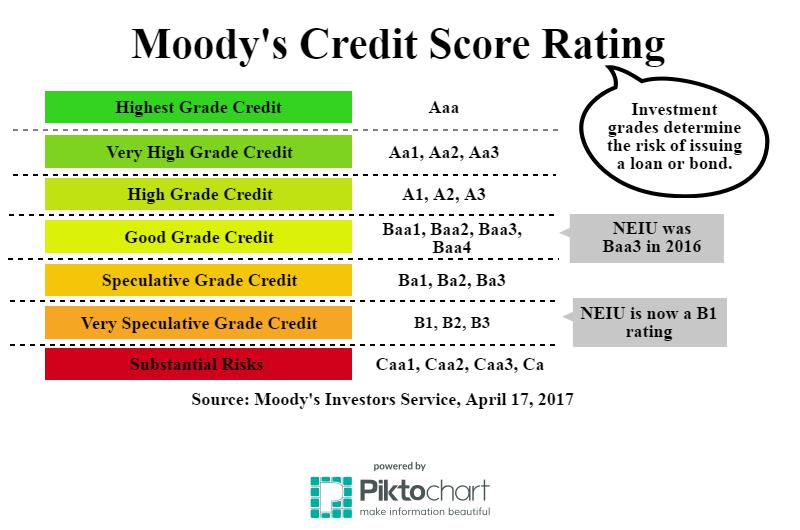

The credit rating score system for Moody’s Investors Service, also indicating where NEIU lies.

May 22, 2017

The financial woes continue for NEIU as a major credit agency announced in an April 17 press release that the school’s credit rating has been lowered two levels.

Moody’s Investors Service downgraded NEIU from a Ba2 to a B1 rating, placing them in a high credit risk category. The press release reflected on NEIU’s “weakened cash flow” mostly caused by the lack of a state budget and declining enrollment. NEIU’s efforts to stay open continue by furloughing employees, initiating hiring freezes and canceling classes.

The credit ratings are based on how likely a borrower will pay back bonds and currently NEIU is at what is commonly known as “junk status.” Last year, NEIU was barely just above junk status with a rating of Baa3, but for almost two years without a budget, the school has been given a negative outlook by the credit score agency.

Moody’s Investors Service also placed six other Illinois universities under review, indicating that they might also get a downgrade like NEIU. A downgrade in rating means that it will cost more for the school to borrow money with interest rates increasing since the risk is higher. These schools include the University of Illinois, Illinois State University, Eastern Illinois University, Southern Illinois University, Northern Illinois University and Governors State University.

Dr. Scott Hegerty, a professor for the department of economics, explained in an email that the downgrade means higher risk for investors.

“Borrowers get less money for a bond, with the difference going to higher interest that offsets the higher risk. Ba2 and B1 are both classified as ‘speculative,’ but the new rating is even riskier,” said Hegerty.

Interim President Helldobler called the news “very disappointing but not surprising” in a statement to the Chicago Tribune.

“The real tragedy here is that after a long history of fiscal responsibility and sound planning, the financial reputations of Northeastern Illinois University and other Illinois public universities are at stake, and this is really a reflection of Springfield’s inaction regarding the state’s budget,” said Helldobler.Officials in Springfield have yet to pass a budget, and the deadline for enacting a state budget for next year is at the end of May.

Emma • Nov 4, 2019 at 11:07 pm

I taught that credit score has lot of fields to look up to, it’s glad I’ve been doing my research to feed myself info, I just read this a while ago about score improvement and the hacks are useful and easy to follow, here’s the link https://www.htpenterprisesfinancial.com/5-great-ways-to-improve-your-credit-score-htp-enterprises-financial/