NEIU Credit Downgraded to ‘Just Above Junk Grade’

More in News

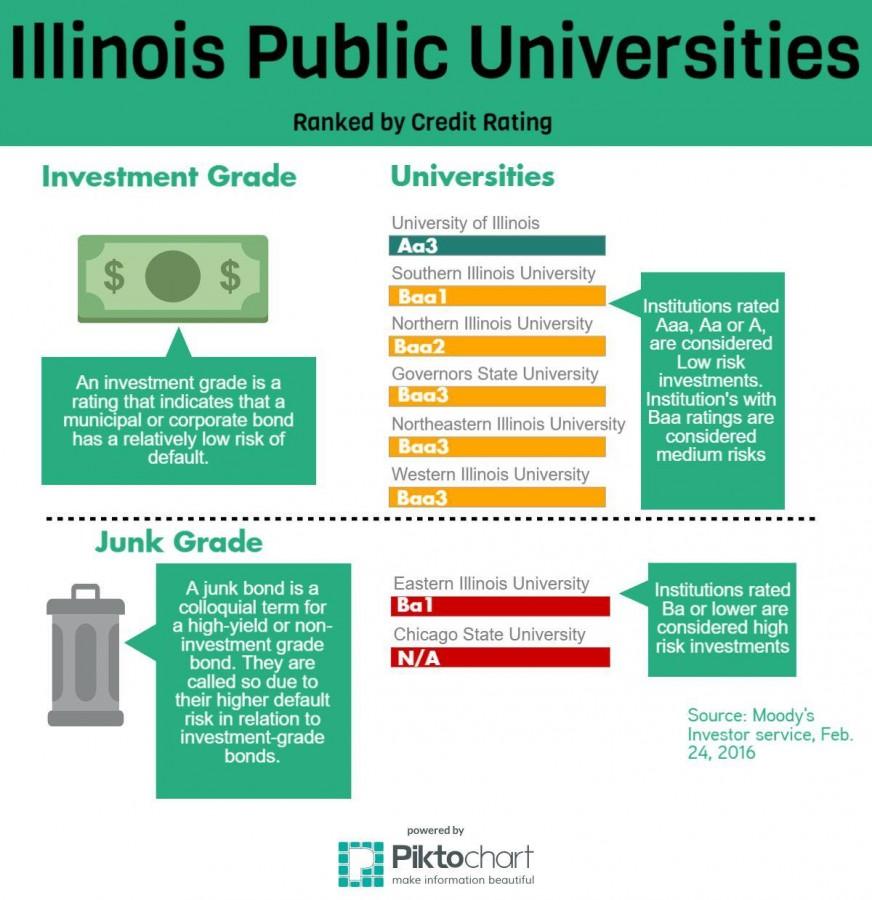

For the third time in three years, NEIU has had its credit downgraded, along with several other state universities.

In a Feb. 24 press release posted by Moody’s Investors Service, a credit ratings agency, NEIU had its rating lowered from Baa2 to Baa3. According to the release, the downgrade “reflects the challenges posed by the state’s ongoing budget impasse, along with declining enrollment, thinning operating performance and execution risk on strategic initiatives.”

Northern Illinois University was also downgraded to Baa2, making NIU and NEIU both one notch above the Ba junk status rating. Eastern Illinois University was given a Ba1 rating, marking it as below investment grade.

All state universities were given a negative outlook by Moody’s as Illinois is currently in its ninth month of being without a budget. Republican Gov. Bruce Rauner and the Democrat controlled state legislature have failed to agree on a statewide budget, resulting in NEIU’s current budget crisis.

Impact on the University

Though a credit downgrade would not immediately affect NEIU, the effects could hurt the university in the long run.

Dr. Scott Hegerty, a professor for the department of economics, said that the Baa2 rating will mean it will cost more for NEIU to borrow money.

“The rating is like a credit score; Interest rates should go up to reflect the increased risk,” he said.

Hegerty explained that when NEIU sells a bond, the price of the bond is lower than what the university will pay back in the future.

“Say a $1 million bond is sold for $900K, and the ‘gap’ is interest,” he said. “A rating downgrade means a bond might sell for $800K, meaning less money now and more interest paid.”

The downgrade also could mean damage for NEIU’s academic reputation, leading to community members or students to view the university itself as a risk.

“It’s possible that people might not want to make a long-term commitment if they think the quality will decline,” Hegerty said. “In that sense, the investment world could affect the students’ or parents’ decisions and hurt enrollment.”

Professor Hardik Marfatia, also said that the downgrade could be costly for NEIU when it comes to borrowing money.

“First, the rating downgrade increases the risk premium demanded by the investors,” said Marfatia. “Second, a downgrade signals the weakening state of our financial position. Hence, even while the economic effects of the downgrade on NEIU’s financial position may not be immediate, the signaling effect can be detrimental.

“However, I do not believe that the potential negative consequences of the downgrade (or the budget impasse) affects the spirit of excellence in education that the NEIU provides,” Marfatia said in an email. “Hence, I have no questions in our ability to tide over these challenging times.”

An NEIU spokesperson said that the university has not defaulted on any of its debts, calling the downgrade a “non-issue.” The university has recently refinanced, says the university rep, and is not looking to borrow any money at the moment.

Your donation will support the student journalists of Northeastern Illinois University's The Independent, either in writers' payment, additional supplies and other items of note. Your contribution will allow us to purchase additional equipment for writers/photographers/illustrators and cover our annual website hosting costs.

Luis Badillo