False Figures Lead to Declining Growth in China

More in News

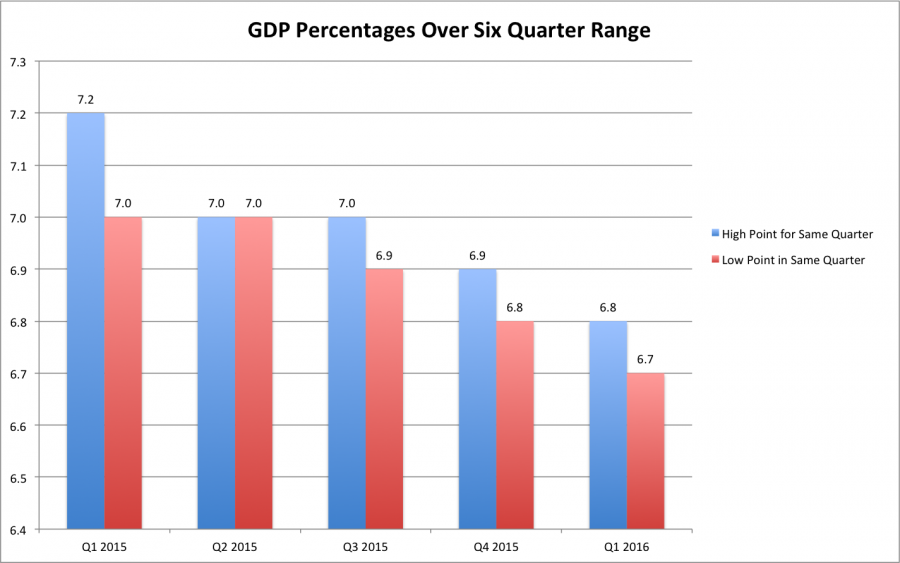

A depiction of the highest and lowest points of GDP growth rates between the first quarter of 2015 to the first quarter of 2016.

China’s gross domestic product growth is steadily decreasing.

According to a Bloomberg report published in April that focused on growth rate patterns and the credibility of data, China’s GDP has further declined in the first quarter of this year.

Chief Asia economist from Capital Economics—an economic research consultancy based in London—Mark Williams said in the article, “If the data is not credible, it affects how investors look at China’s policies in general. The lack of credibility also makes it much harder for China’s policy makers to do their job.”

China’s declining GDP growth rate is reported in figures ranging between 7.2 down to 6.8 percent.

If the National Bureau of Statistics is producing fake data to make China’s growth appear more prominent than it actually is, this would correlate with information given in the article of the inevitable wipe out of $6 trillion USD in stock valuation around the globe.

Due to the lack of transparency by the NBS, this would affect the asset and money market because the original figures were calculated fabrications. Should the allegations turn out to be true, the asset market would be less than reported, contracting GDP, increase the exchange rate, and strengthen the yuan.

Exports would decrease. Imports would, theoretically, increase resulting in a budget deficit. In addition, the domino effect would result in a spike in interest rates leading to less money in circulation and less spending because goods and services are suddenly expensive.

Wang Bao’an, the former chief executive officer of NBS defended the published statistics. Shortly before being replaced by “a close adviser to Premier Li Keqiand,” Vice Chairman of the National Development and Reform Commission, Ning Jizhe.

Bao’an is currently under investigation on charges of corruption.

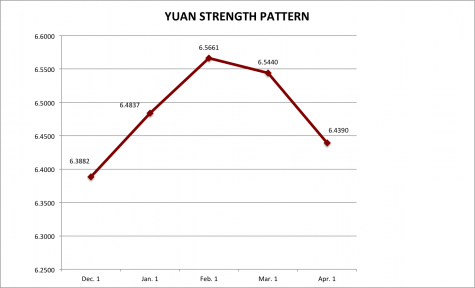

An investigation on corruption should weaken a country’s currency but the yuan has showed a slow and miniscule strengthening against the U.S. dollar, measured against 1 USD, from 6.4837 yuan in January to 6.4390 in April. Patterns can be seen as depicted in the graph.

Although political leaders have not made an official announcement of the new exchange rate regime, the concern amid corruption scandals are lagging levels of output and a slowing economic situation.

China’s exchange rate regime has gone from a hybrid of a fixed rate and peg-and-band to a managed float. A fixed exchange rate, theoretically, stays the same or is “fixed” at a certain percentage and this allows the central government to have control over the exchange rate but not the domestic money supply.

A peg-and-band exchange rate allows a country’s central bank to tie or “peg-and-band” the value of their currency’s rate of exchange to that of another country’s wherein a managed float exchange rate allows a country’s central bank to retain some control over the domestic money supply but the cost is greater rate of exchange instability.

*This article was adapted from an Economics term paper the wrote in May. Information may have been updated in the time between the publication of this issue.

Your donation will support the student journalists of Northeastern Illinois University's The Independent, either in writers' payment, additional supplies and other items of note. Your contribution will allow us to purchase additional equipment for writers/photographers/illustrators and cover our annual website hosting costs.

Rut Ortiz